Finance masters graduates brace for an uncertain market

As elements of the world bit by bit arise from lockdown, Kelly Chaaya is getting ready to start out her internship at a global financial institution. But the masters in finance pupil at HEC Paris will not be likely into Citibank’s London workplace — as an alternative her work will be performed remotely.

Even with the abnormal situation and economic uncertainty brought about by the coronavirus pandemic, Ms Chaaya is optimistic about her prospective clients in the finance field. “There will be some changes . . . but it is not likely to be as impacted as other sectors, such as the media,” she suggests.

But those people finishing their MiF programs now join a lot of other graduates who will have the difficult job of acquiring a vocation all through a time period of global economic shock.

Sentiment about internships and task delivers is mixed among small business faculties and students, so it is difficult to forecast how the landscape for MiF graduates will change in excess of the coming months. Broadly, however, there is a experience that the finance field will hold steady.

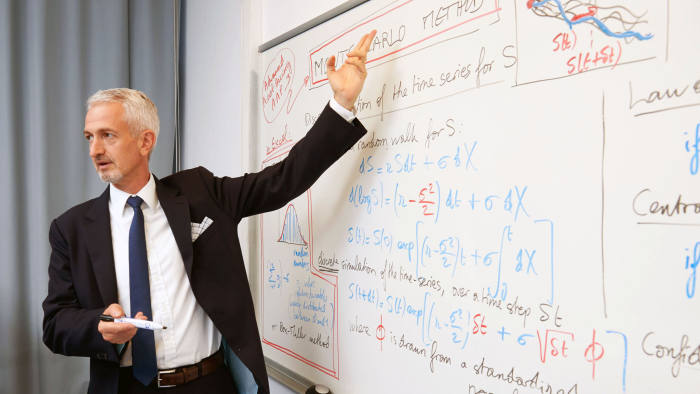

Olivier Bossard, executive director of HEC’s MiF, suggests the only factual observation he can make for the small business school’s graduates is that corporations are delaying or shortening summer season internships. “The large expenditure banking institutions are basically enjoying a pretty truthful-play activity with our graduates,” he suggests.

When it arrives to task delivers, those people using the services of from HEC are “still completely committed” to choose individuals, Prof Bossard adds. “Only three corporations so significantly have acknowledged that they would not be capable to honour their commitments.”

Overall he does not anticipate large adjustments with expenditure banking institutions. He points out that the pandemic has developed a disaster in the genuine economic climate. “Relative to 2008, the banking institutions are in a significantly superior shape: a lot more liquidity, superior capital adequacy, challenges are a lot more below regulate,” he suggests. While things are alarming, “it is not, at least for now, a remarkable situation particular to banking institutions, or the money sector.” Prof Bossard is a lot more concerned about the consulting sector, which he thinks could be hit by expense-preserving steps.

Anna Purchas, head of individuals at qualified companies business KPMG, suggests that at this phase it is difficult to forecast how the jobs market place in consulting will change for MiF graduates. But “some parts of the small business, such as restructuring, are likely to be pretty, pretty very hot,” she suggests, “and that is an location in which a robust analytical track record and comprehending of small business is extremely helpful”.

The corporation has cancelled its summer season internship plan as it did not believe it could give its candidates the finest experience, but some of those people due to choose element have been presented sites for the 2021 graduate ingestion.

In the US, nevertheless, Peter Cappelli, director of the Centre for Human Methods at Wharton Enterprise School, suggests internships are currently being rescinded. He adds that, whilst the corporations cancelling placements have not finalised selections on task delivers, “my guess is that those people will be rescinded as well”.

Even so, Prof Cappelli thinks the finance sector could be much less affected than some others “because finance and investing goes on”.

Christian Dummett, head of London Enterprise School’s vocation centre, suggests the task market place is constantly modifying. In finance, asset courses and subsectors slide in and out of favour, whilst technological innovation has disrupted common corporations. “Crises can speed up this,” he suggests. But he thinks that “coronavirus is a lot more probably to have an affect on the way we work — from dwelling, much less vacation — relatively than roles per se.”

Given that MiF graduates encounter uncertainty and could be competing from larger quantities of students for much less jobs, what competencies do they need to ensure a prolonged-expression vocation and how can they create them whilst finding out?

Casper Quint, an MiF pupil due to graduate afterwards this year from London Enterprise School, suggests that as before long as students commence their programme, they really should start out to create an notion of what they want to do. “Investment banking has a pretty different recruitment system from, for illustration, fintech,” he suggests.

LBS’s vocation centre served him system his solution, whilst he also suggests students really should “reach out to alumni”.

Ms Purchas thinks a main talent is exhibiting adaptability. Graduates need to keep an eye on in which the market place is increasing and in which it is contracting, and believe about how they can posture by themselves.

“When I believe about my vocation, it has been a portfolio vocation,” she suggests. “I believe that truly is the way for individuals to believe about their careers. There will be phases. You can find out from every single [one particular], establish on it and transfer across.”

She adds that, whilst they are performing their MiF programme, students really should also be networking and studying from their friends, so they can exhibit that they can thrive among individuals from assorted backgrounds.

Ms Chaaya suggests that whilst no one particular expects MiF students to be geniuses, they do need to know a great deal about the complex aspects, as effectively as curious — “ask questions”, she advises. When interviews commence to develop into discussions relatively than experience like a grilling, the chance of achievements raises.

Even with the prospect of a tough time period ahead, she suggests finance to anyone fascinated in functioning with quantities. There is constantly work, she suggests, “in the excellent occasions and terrible times”.