UK house price growth cools as rate rises pinch

UK house price growth cooled in September, with the average cost of a home easing from an all-time high as a rise in borrowing costs reduced affordability, the mortgage provider Halifax said.

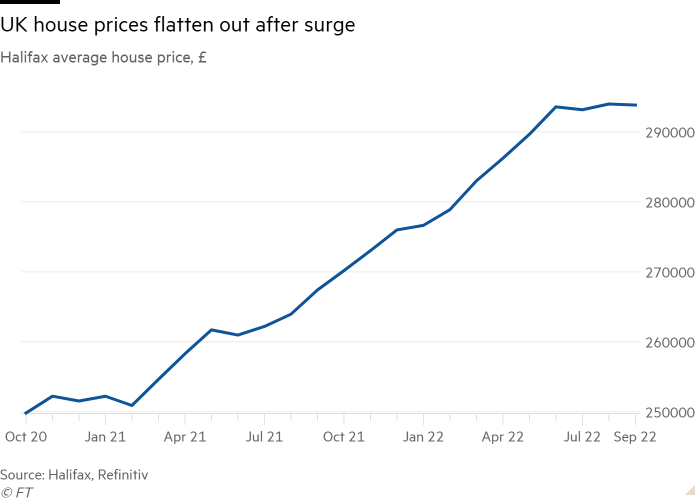

Prices fell 0.1 per cent between August and September, pushing the annual rate of growth to 9.9 per cent, from 11.4 per cent in the previous month, the lender said on Friday. The cost of a typical home edged down to £293,835, from the previous month’s record of £293,992.

House prices have been flat since June, compared with a rise of more than £10,000 during the previous quarter, “suggesting the housing market may have already entered a more sustained period of slower growth”, said Kim Kinnaird, director at Halifax Mortgages.

The mortgage provider Nationwide this week also reported house prices flatlining in September.

The government’s September 23 tax-cutting fiscal statement prompted many lenders to pull mortgage products as expectations grew for a sharp rise in borrowing costs.

Mortgage rates are set to rise to about 6 per cent next year. They were already rising in tandem with the Bank of England’s key policy rate, which at 2.25 per cent is at the UK’s highest level since 2008.

Many economists expect that this will result in many homeowners struggling with mortgage rates and a sharp contraction in house prices.

Most regions reported a slowdown to a single-digit rise in annual house prices, Halifax said, with the exception of Wales where growth remained strong at 14.8 per cent.

London still has the slowest annual rate among the UK nations and regions, with house prices rising by 8.1 per cent.

Kinnaird said stamp duty cuts, the short supply of homes for sale and a strong labour market will continue to support house prices.

However, he added that “the prospect of interest rates continuing to rise sharply amid the cost of living squeeze, plus the impact in recent weeks of higher mortgage borrowing costs on affordability, are likely to exert more significant downward pressure on house prices in the months ahead”.